Catalogue companies consider a number of factors when calculating how much credit to extend to you. This includes your credit score, your employment status, your area of residence, and if you have any outstanding debts.

This is the maximum amount you can spend using your catalogue credit account. Sometimes, we are faced with an unexpected expense that is not planned. Unfortunately, some of these expenses are necessary and cannot be postponed, but the chances of you paying for the expenses are slim because of your tight budget. Perhaps you were waiting for your cheque to mature in order to purchase a graduation suit. But the cheque bounced at the last moment.

Each state will have its own method of determining your eligibility. This includes checking if your current account is active and if you have a regular income stream. Catalogues for people with poor credit histories are likely to have higher interest rates that other options because they are considered high-risk borrowers. Only valid on new customer first credit orders, when opening a Studio Pay Credit Account. Studio reserve the right to withdraw the promotion at any time, without prior notification.

The best catalogues that cater to people with bad credit offer installment plans and monthly payments so that customers can repay their debts while still being responsible about managing their finances. These companies allow customers to pay off debts after six months of https://www.buynowpaylatercatalogues.co.uk regular installments or within 12 months with a lump sum payment. Created in 2011, K & Co. is both an online and print home shopping catalog company that is a combination of Great Universal, Kays and Empire Stores.

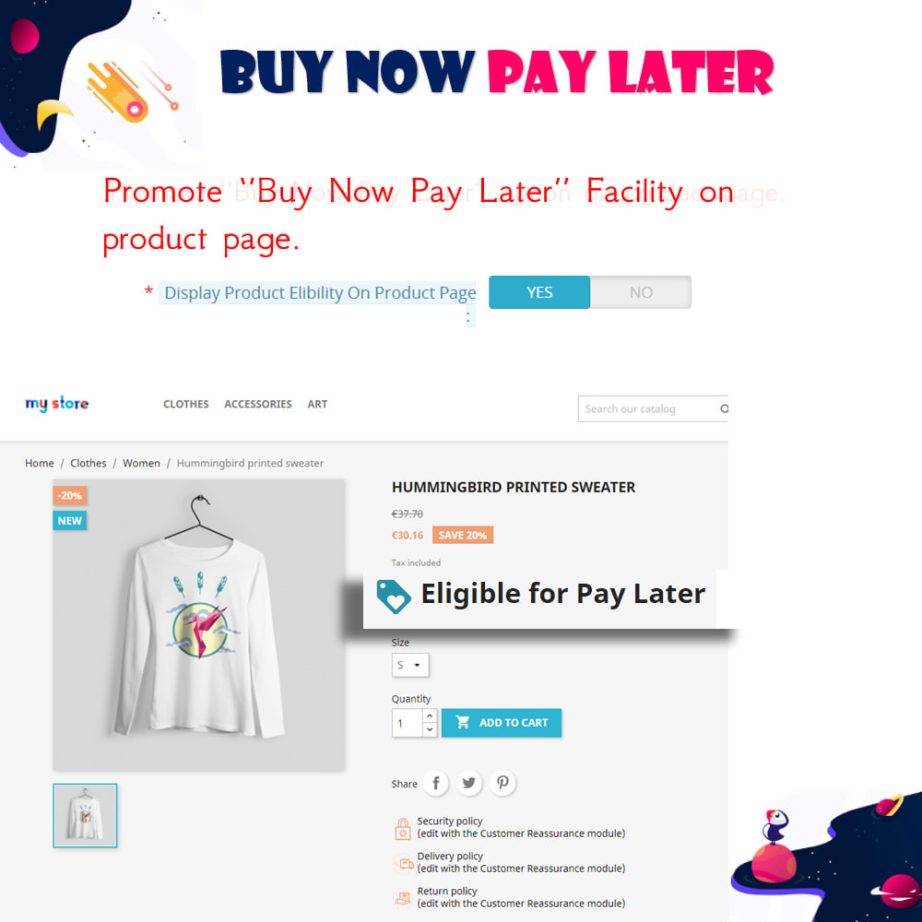

Spread the cost of your shopping across a time period that suits your budget. Until the introduction of Yes Catalogue the only way you could achieve credit was to have a credit check and if you have suffered with a poor credit score… So don’t forget to take a look at what payment options are offered by any given catalogue as some options may be more suitable to you than others. Firstly, you’ll want to be conscious of the interest rate offered by a catalogue and ensure that you’ll be able to make the payments which will include a given representative APR. Unfortunately, most catalogues lack a no credit check option but there still are a significant number of these catalogues on the market to choose from. Some will let you make purchases and pay some of the cost upfront while paying the rest later .

Top 10 Bad Credit Catalogues For 2023 – Finance.co.uk

Top 10 Bad Credit Catalogues in 2023. [More information]

After creating an account, you can browse products and choose what you want to purchase. To complete your order, drop the items into the online basket. Dial a TV has the lowest APR in the UK for renting to buy products. This is perhaps the reason the company has seen an increasingly growing customer base over the past few years. Online retailers love BNPL providers because it makes it less likely that you’ll abandon shopping basket.

The company will send you details about what you have ordered and the balance to your account every 28 days. One twelfth of your balance is the amount of the minimum monthly payment that is due, and the payment amount must be at least 5 pounds. After you have established a payment history that is consistent, the amount of the monthly payment can be reduced. The process is very simple, for an online credit application, and if you are approved, a credit limit of 100 pounds will be given to you. To be approved for a credit card account, you must be a UK resident and at least 18 years old. If you have a personal account with JD Williams, you are required to pay a minimum monthly amount.

Top 10 Bad Credit Catalogues For May 2022 – Finance.co.uk

Top 10 Bad Credit Catalogues For May 2022.

Posted: Thu, 03 Mar 2022 20:07:05 GMT [source]

You may be increasing your interest rate by not paying, which could lead to a court case or severely damaged credit rating. For example, if you bought goods worth $100, you will need to pay $5 per Month. As such, the quicker you repay the debt, the less interest is incurred.